Join an industry-leading

Aggregator

Reach your full potential with Vow Financial’s exceptional competitive advantage. Count on us to provide unwavering support, access to a strong network of lenders and partners, and invaluable resources, ensuring that you are never alone. Benefit from our team of experts who are dedicated to your success.

Welcome to Vow Financial

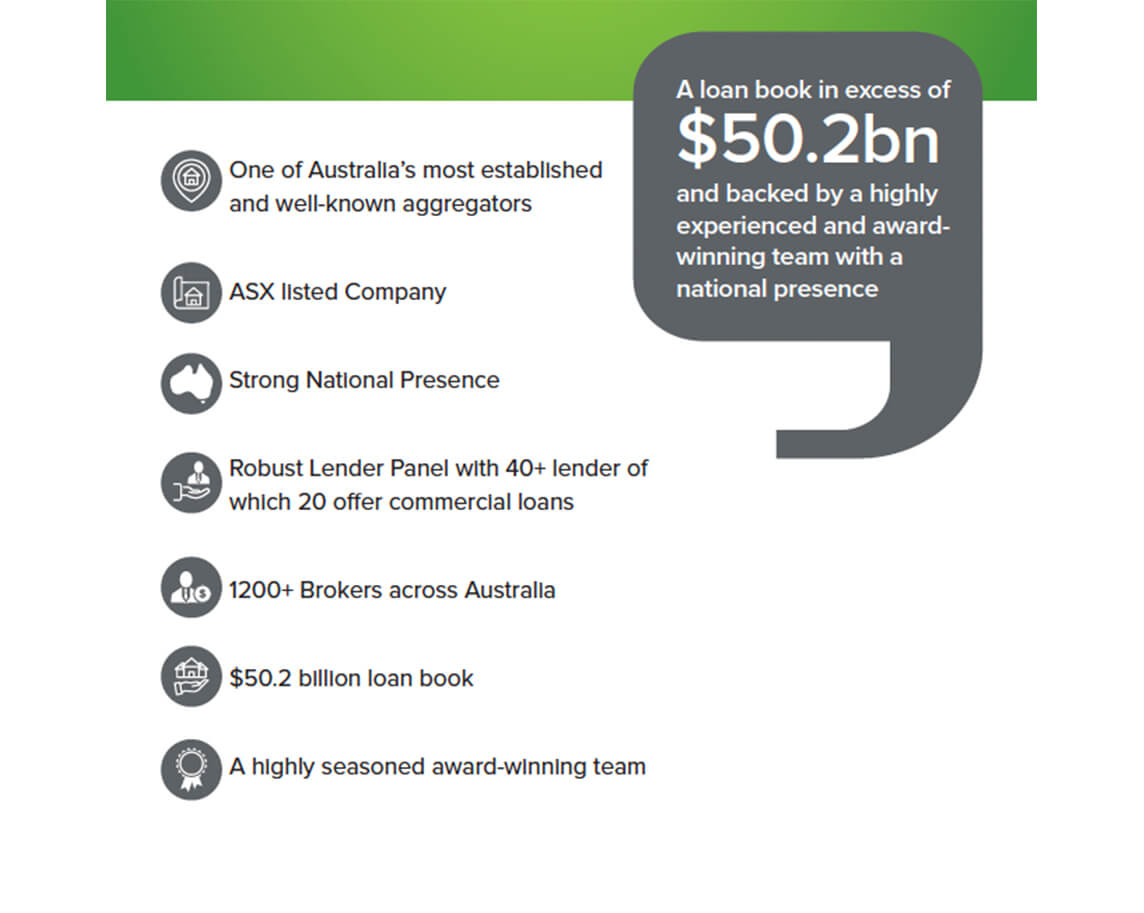

Vow Financial, with over 1,250 brokers managing $45 billion in loans, is a dynamic force in the Australian mortgage and finance industry. Since merging with the Yellow Brick Road Group in 2014 under the brand Vow Financial, we’ve been on a mission to empower brokers.

Our journey began in 2010 when National Brokers Group, The Mortgage Professionals, and The Brokerage united to create a powerful brokerage support system. We’re committed to keeping brokers at the center of our business, providing them with the tools to control their business’s future.

Recognised with accolades like the ‘Wholesale Aggregator of the Year’ at the MFAA Excellence Awards in 2011 and 2012, we’ve also opened doors to cross-sell opportunities in asset finance, commercial, and personal loans, as well as a network of specialist lenders and services, helping our partners retain clients and boost their business revenue.

A Model That Suits You

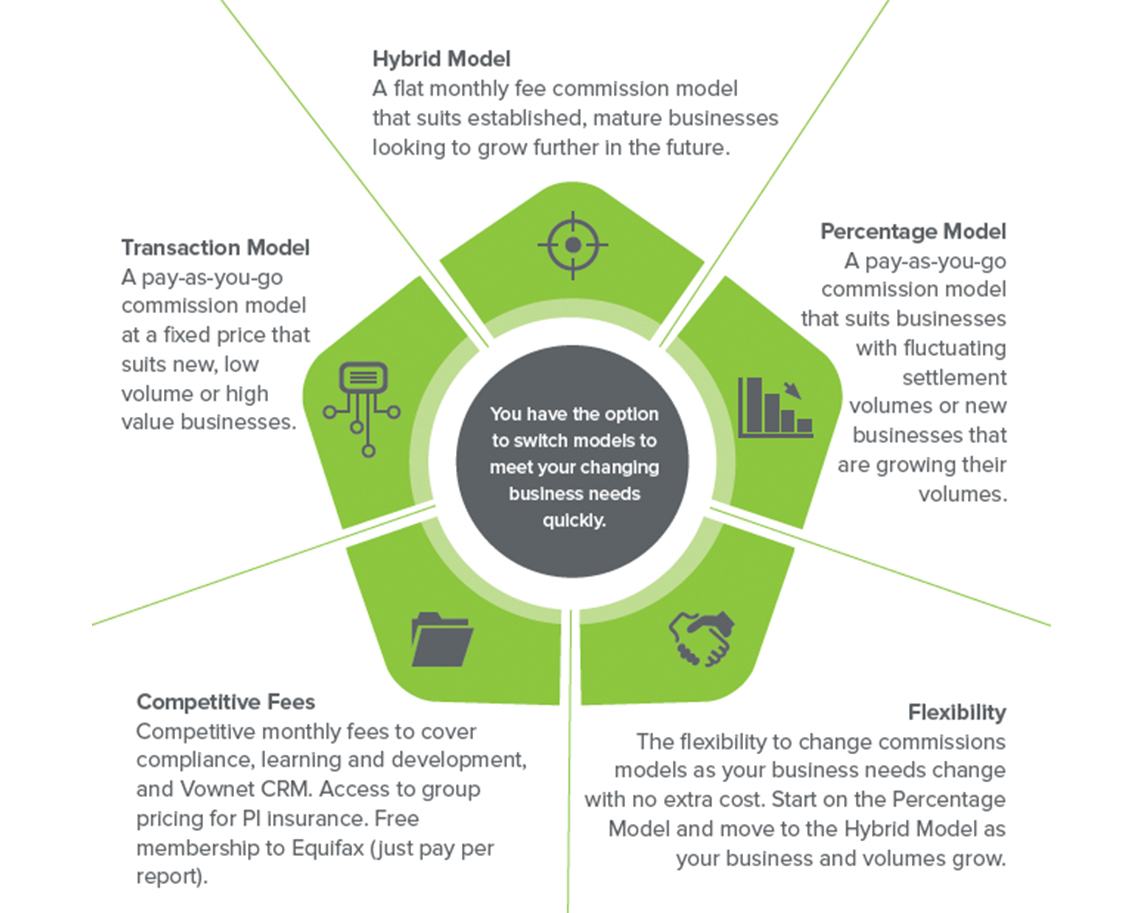

Choose the aggregation model that suits your business. No matter what agreement you’re currently on, we have a model which suits your business journey.

Competitive Percentage Model

This plan suits businesses not sure what their settlement volumes will be in the first few months of operation. Your commissions grow as your settlement volumes increase – talk to a Vow State Manager today.

Mortgage Upfront Commission Scales depend on what volumes you are currently writing. We have tiered commission rates, depending on your volumes. Get in touch with us today to see what better deal we can do for you! You will have access to all Vow’s support services and business partner relationships.

Transaction Model

The ‘Fee per settled deal’ plan suits businesses not sure what their settlement volumes will be going forward. It involves only a very small fee per settlement each month. You will have access to all Vow’s support services and business partner relationships.

Pricing:

$195.00 (+ GST) fee charged per loan settlement

$5.50 (+ GST) fee charged per trail transaction

Why Join Us?

The first aggregator business deliberately founded and shaped in response to its’ brokers’ needs.

The key for us at Vow is to have a flexible and responsive model of service, where we adapt to fit your needs not the other way around. We listen first, ask the right questions, seek feedback, and importantly act on what we say. The loyalty of our valued clients, the Vow brokers, is a testament to the strength of this service model and to the relationships we hold with our brokers. It’s this understanding and mutual respect that motivates and drives us in partnership to deliver business success all around.

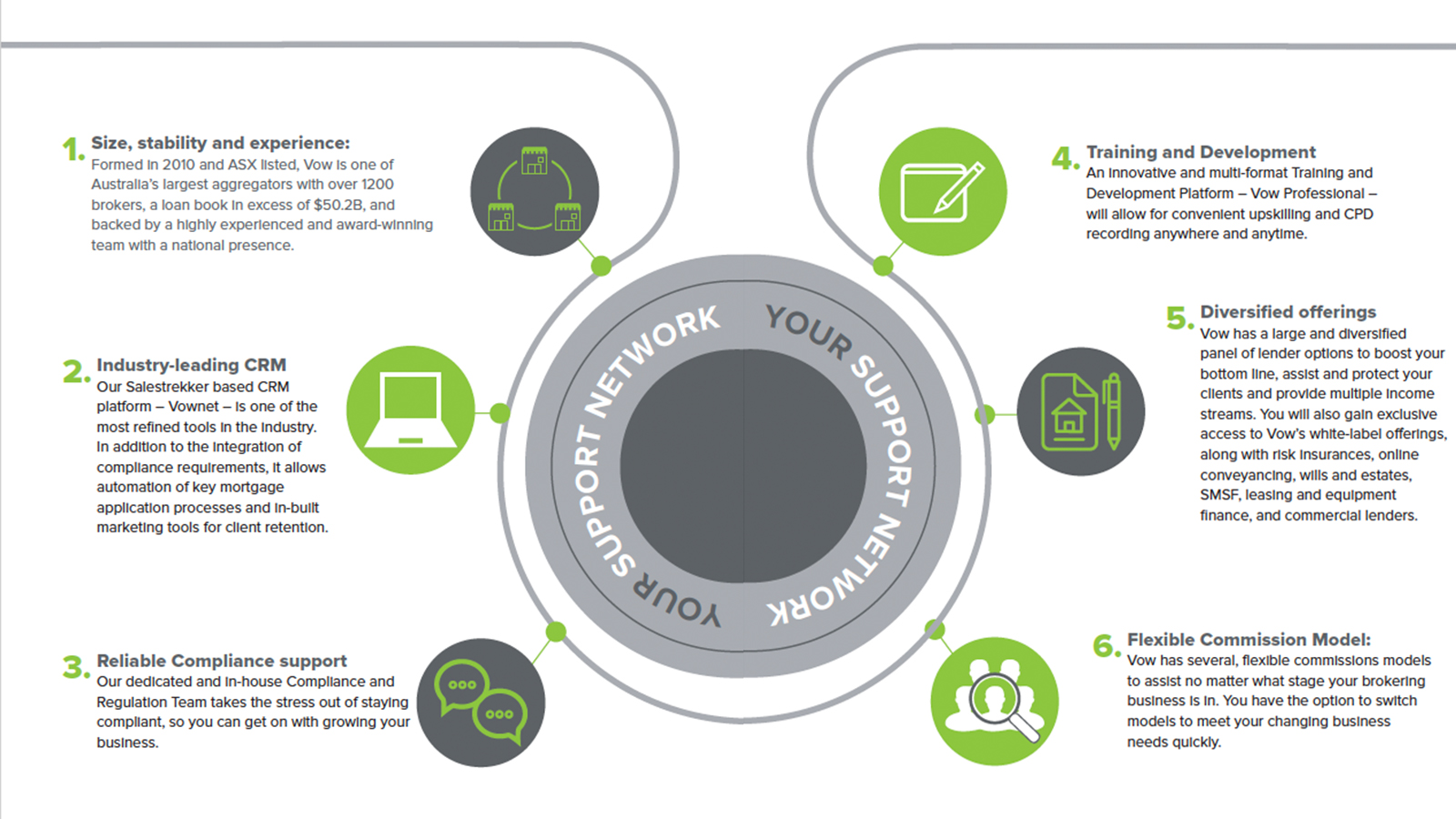

Size, stability, and experience.

Vow Financial is one of the largest aggregators in Australia with over 1200 brokers, over a $45bn loan book and a highly experienced and awarded State Manager team with a national presence.

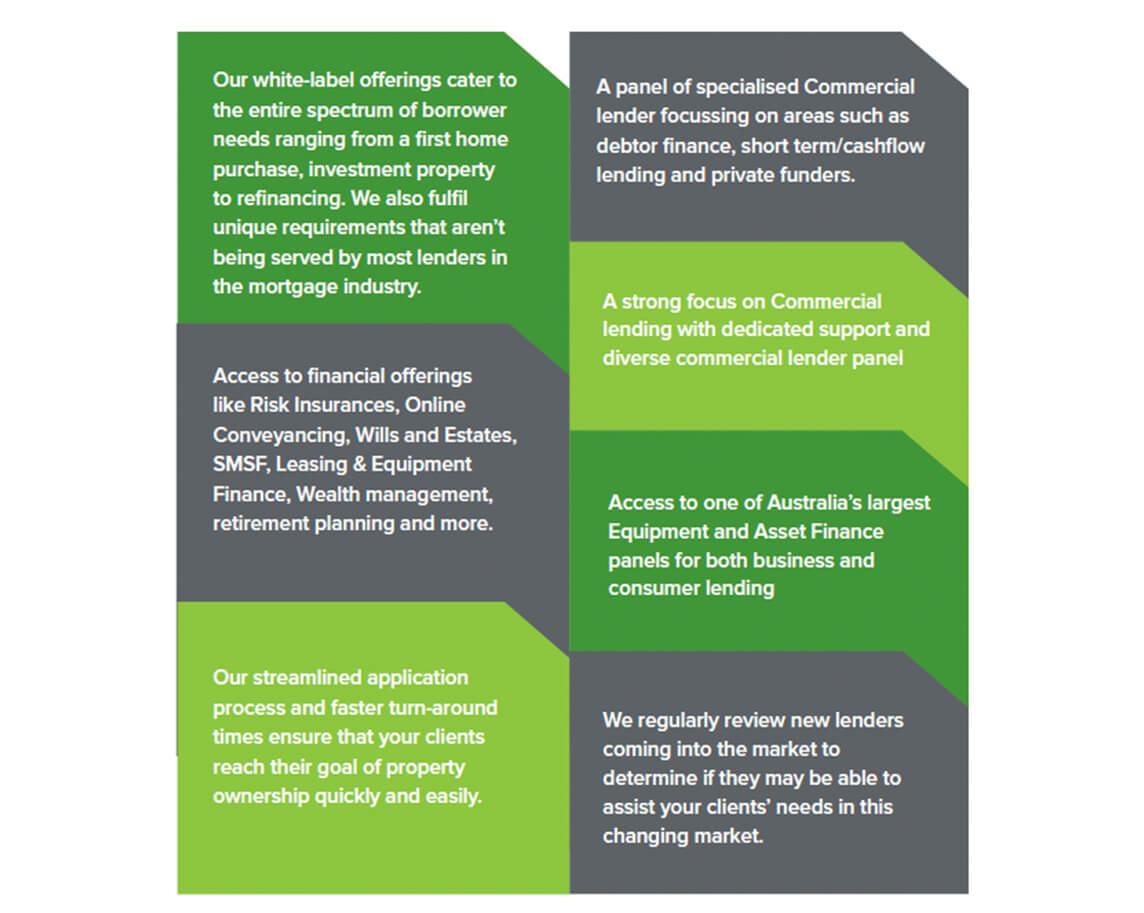

Diversification made easy – Wealth, Vow Legal & Leasing

We have a number of referral sources to boost your bottom line, protect your client and add multiple income streams to your business. Products such as Risk Insurance, Online Conveyancing, Wills and Estates, SMSF, Leasing & Equipment Finance, Wealth creation strategies, retirement planning and more.

Strength you can count on.

Our Broker Investment Program means you have the assurance of a flexible range of options to help steer your business forward whether it’s growth via loan book purchasing, cash flow turbo boosting or selling the business or loan book when you are looking to exit the industry or retire. Vow will even help fund the purchase of mortgage loan books.

Your own dedicated compliance team.

Our brokers have access to a dedicated compliance and regulation team to assist and support them. In keeping with our philosophy of empowering our brokers, Vow was one of the first aggregators to allow you to make your own decision about whether to gain your own ACL or become an ACR of Vow Aggregation. Either way, we’ll do whatever we can to take the stress out of compliance and regulation so you can get on with growing your business.

Expert Marketing Support

Our dedicated marketing partners are on hand to help our brokers with marketing support, tips and advice plus the supply of design services such as logo development, collateral, website design or client communications such as email campaigns and social media.

Services we offer

SIZE, STABILITY AND PRESENCE

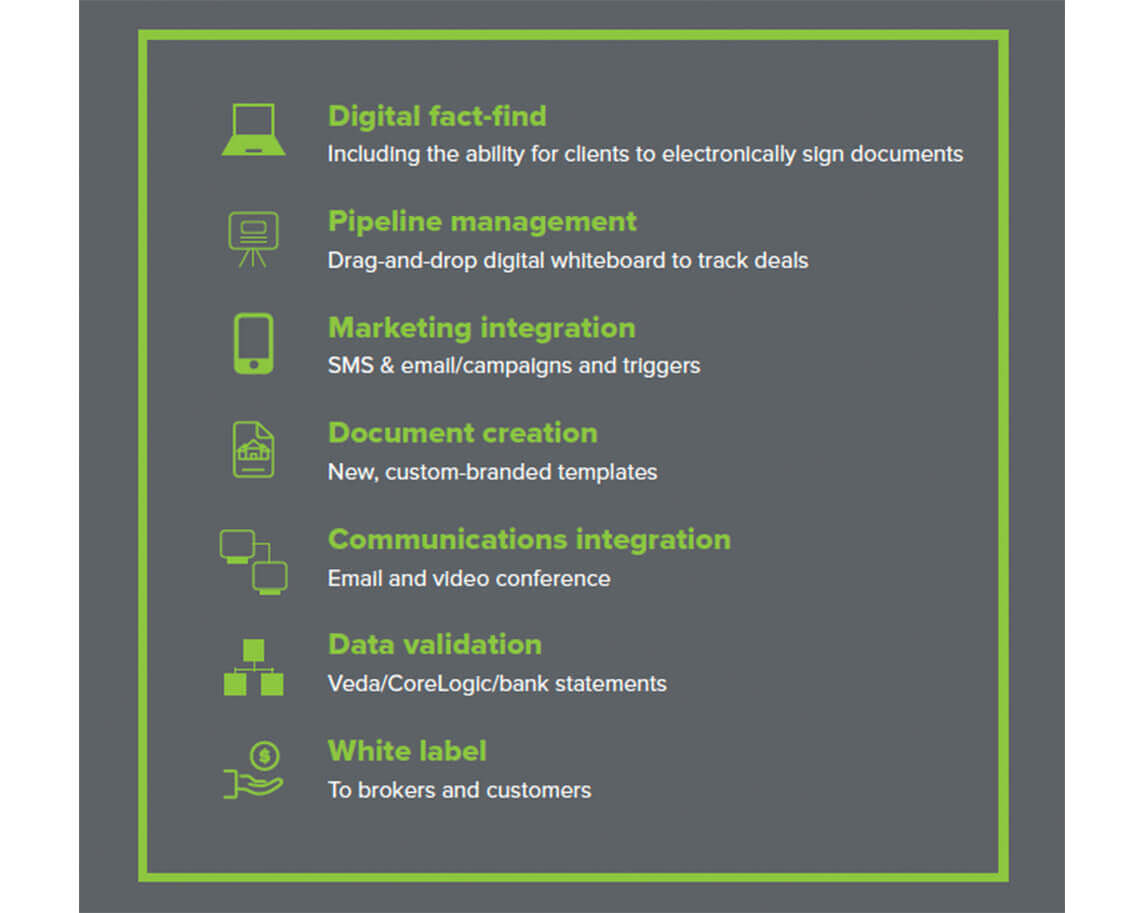

VOWNET: INDUSTRY-LEADING CRM

RELIABLE COMPLIANCE

TRAINING AND DEVELOPMENT

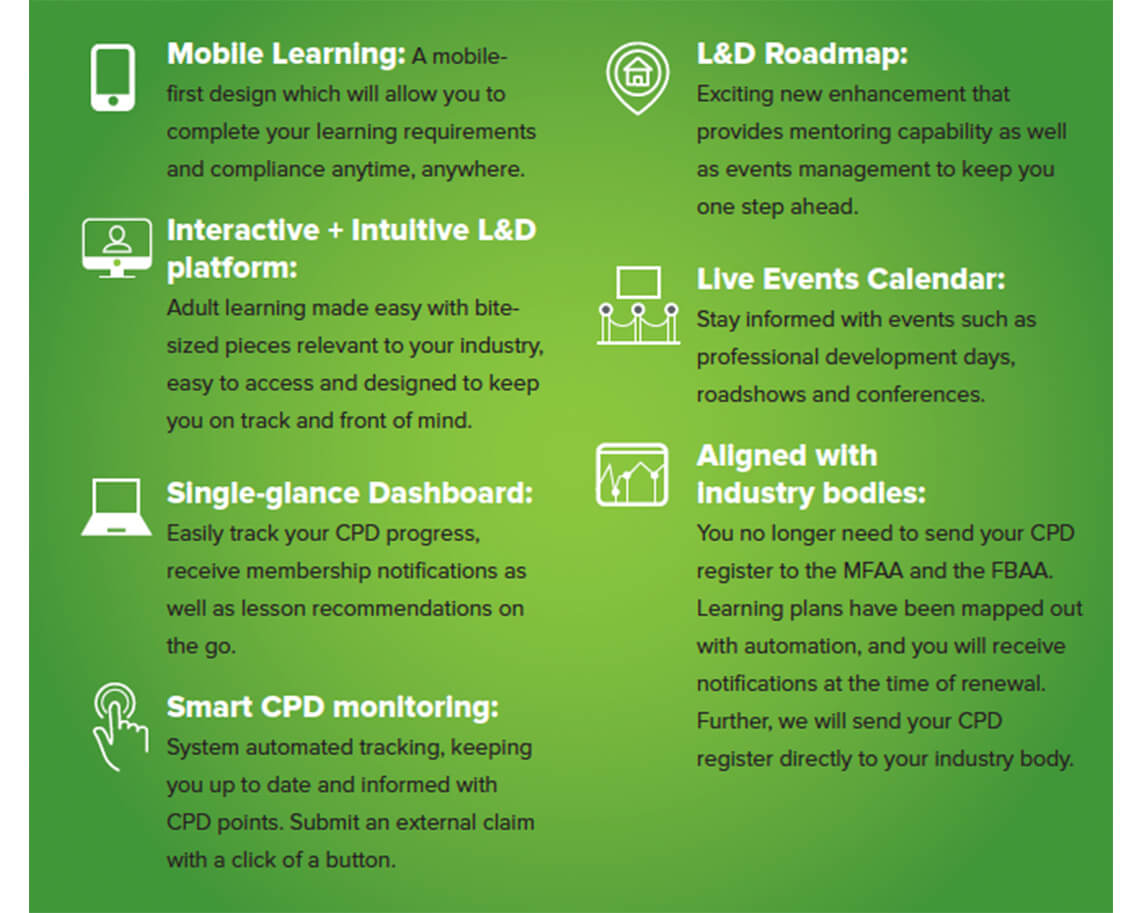

Fulfil your professional requirements and stay abreast of all latest policy developments along with industry best practices. Enjoy a systematic trackable approach to paced learning through our multi-format platform you can access anywhere anytime. Some industry-leading features include:

GUIDANCE

We invest the time to understand your needs holistically and completely before asking questions.

With Vow, you will enjoy the support of:

FLEXIBLE COMMISSION STRUCTURE AND COMPETITIVE FEES

THINKING OF GETTING INTO BUSINESS EQUIPMENT OR ASSET FINANCE?

Ways of generating additional income, What better way than dealing with our Leasing Specialists who have access to the best products and pricing in the market place.

Require more information? Contact;

Glenn Mitchell

Head of Commercial & Leasing

DIVERSE PRODUCT ARRAY

We understand that each borrower is unique.